This article was created by AI and verified by a human for accuracy.

Online betting has evolved into a high-tech, data-driven industry powered by artificial intelligence (AI), blockchain, and immersive virtual experiences. From tailored odds to real-time streaming, today’s platforms offer personalized, interactive betting environments that go far beyond simply picking a winner.

While innovation moves at lightning speed, global adoption and regulation vary dramatically — shaping how technology transforms the betting experience from one market to another.

AI now powers nearly every aspect of modern sportsbooks and online casinos. It analyzes huge datasets — from player stats and injuries to weather conditions — to adjust odds instantly and personalize user experiences. Machine-learning algorithms detect betting patterns, helping operators identify risky behavior and promote responsible play.

Blockchain adds another layer of integrity through transparent, tamper-proof ledgers and automated smart contracts that handle payouts and reduce fraud.

Meanwhile, VR and augmented reality (AR) are paving the way for immersive wagering. Imagine donning a headset, taking a virtual seat courtside, and placing a live bet with a simple gesture — all while watching odds float dynamically around you.

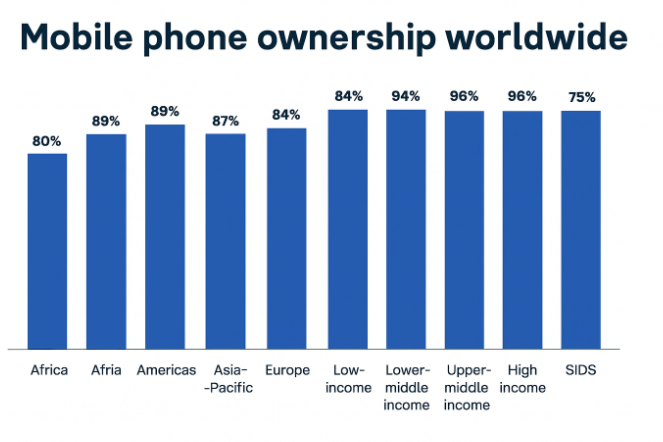

Technological adoption is far from uniform across regions. North America and Europe lead the way, with smartphone ownership exceeding 95% and extensive 5G coverage enabling real-time betting, instant cash-outs, and live chats with dealers.

Asia–Pacific shows similar smartphone penetration but faces uneven rural connectivity. Latin America, led by Brazil and Mexico, is catching up quickly — more than 80% of adults now own smartphones.

Africa and the Middle East still lag, with mobile penetration around 78%, and payment systems remain fragmented. Brazil’s PIX, for instance, processes deposits in seconds, while cryptocurrencies account for just 8% of payments.

These disparities shape how betting platforms are built. In connected regions, operators deliver high-definition live streams, biometric logins, and app-rich ecosystems. In emerging markets, they focus on lightweight web apps and SMS-based betting for accessibility.

Regulation adds further complexity: countries like Colombia and the UK run tightly controlled markets, while others — such as Chile — continue to operate in legal grey zones.

Leading bookmakers are pushing the boundaries of technology to enhance engagement and stand out in crowded markets.

Latin America showcases how rapid mobile adoption drives betting growth despite regulatory uncertainty. Mobile-first platforms dominate, offering low-data web apps with live-streaming, instant cash-outs, and personalized AI-driven promotions.

Payment innovation plays a vital role. Brazil’s PIX (featured on the Central Bank’s official site) powers most gaming deposits and withdrawals. Peru’s Yape and Plin, and Argentina’s Transferencias 3.0 provide similar real-time payment systems. Cryptocurrencies remain niche, used by about 8% of Brazilian players due to regulatory limits.

Social media also amplifies engagement. Studies show that 70% of bettors on Twitter/X check odds or place bets around trending events — a sign of how creator picks, live updates, and embedded odds widgets influence betting behavior.

Operators in Latin America leverage AI and analytics to predict player churn, customize offers, and adjust odds dynamically. Combined with widespread smartphone use, this results in personalized, gamified betting environments that boost retention and engagement.

While Colombia leads with a fully regulated online market, countries like Brazil, Peru, and Argentina are still drafting legislation. Chile remains in limbo — despite high 5G adoption, its Superintendencia de Casinos de Juego (SCJ) allows only state-authorized betting. Until clear laws emerge, grey-market operators continue to serve Chilean bettors through mobile-friendly platforms.

Chile’s advanced digital infrastructure — with 82% 5G coverage and millions of smartphone users — contrasts with its lack of formal online gambling regulation. Yet, several brands have adapted to local demand:

The next chapter of online betting will be written at the intersection of technology, ethics, and regulation.

AI will continue to shape personalized experiences — but regulators must ensure these tools protect users from harm. VR and AR could redefine sports viewing, provided affordable devices and high-speed networks reach broader audiences.

Ultimately, innovation will thrive where technology meets clear governance and consumer trust. Markets that balance these forces — blending regulation with innovation — will set the global standard for the next generation of online betting.

AI analyzes massive data sources — from player stats to match conditions — to set live odds and personalize offers. Machine learning also helps identify at-risk behavior for responsible gaming.

A: It ensures transparency and fairness by recording bets and payouts securely on public ledgers, reducing fraud and manual errors.

High smartphone adoption and instant payment systems like PIX make mobile apps the most efficient way to place and manage bets.

Despite widespread 5G connectivity, Chile lacks a defined online betting law, leaving operators in a legal grey area until regulation catches up.