Argentina’s online gaming industry reached a turning point in 2025. No longer a niche pastime, online gaming has become an integral part of the country’s entertainment ecosystem. Fueled by widespread smartphone adoption, expanding digital infrastructure, new provincial regulations, and a passionate gaming culture, Argentina’s iGaming sector now generates more than US$1.57 billion in 2025, with over 4.6 million active online bettors.

The fusion of gaming, sports betting, and mobile innovation has changed how Argentines play, pay, and interact online. This transformation reflects broader trends in global iGaming but remains uniquely Argentine, deeply tied to soccer fandom, mobile-first interactions, and an emerging esports economy.

By the start of 2025, Argentina had over 41 million internet users, representing 90% population penetration—one of the highest rates in Latin America. The average adult spends more than five hours daily on a smartphone, and most gambling-related queries and activities occur via mobile platforms.

In this hyperconnected landscape, mobile gaming has surged beyond simple casual gaming apps. It now includes live casino streaming, esports betting, and augmented-reality gambling experiences. The mobile gaming segment alone reached a user penetration of 28.5% in 2025, projected to exceed 32% by 2030.

Buenos Aires, Córdoba, and Santa Fe lead the charge, offering regulated online platforms optimized for mobile use. Operators compete to provide native app experiences equipped with fast-loading interfaces, personalized bonuses, and instant payments using digital wallets such as MercadoPago and cryptocurrencies.

One of the defining features of Argentina’s online gaming ecosystem is its decentralized regulation. Each province manages its own rules, licensing fees, and taxation rates, making the market both dynamic and complex.

Platforms that succeed in Argentina are those that fully localize content—adapting language, themes, and payment options to resonate with Argentine preferences. Players expect Spanish-language UX, loyalty programs tied to local soccer teams, and customer service that understands regional betting customs

However, this regulatory mosaic has also led to challenges: about 80% of all bets in Argentina are placed through unregulated sites, blurring the lines between legal and illegal operations. This reinforces the importance of building trust. Licensed platforms promote transparency through blockchain technology, responsible gambling tools, and rapid verification systems aimed at preventing underage play

The Argentine online gambling sector is forecast to maintain a compound annual growth rate (CAGR) of around 9% between 2025 and 2026, reaching US$1.72 billion by next year.

This sustained growth is driven by several key trends:

New entrants are leveraging this momentum by offering localized casino platforms, esports wagering portals, and app-integrated payment solutions. To learn more about leading betting apps in Argentina, this guide to the best betting apps in Argentina outlines the top-performing options for players in 2025.

Recent surveys conducted by G&M News and ALEA (Argentine State Lotteries Association) reveal striking patterns about Argentine player habits. Approximately 78% of those who placed a bet in the past year did so at least monthly, representing about 10% of the adult population.

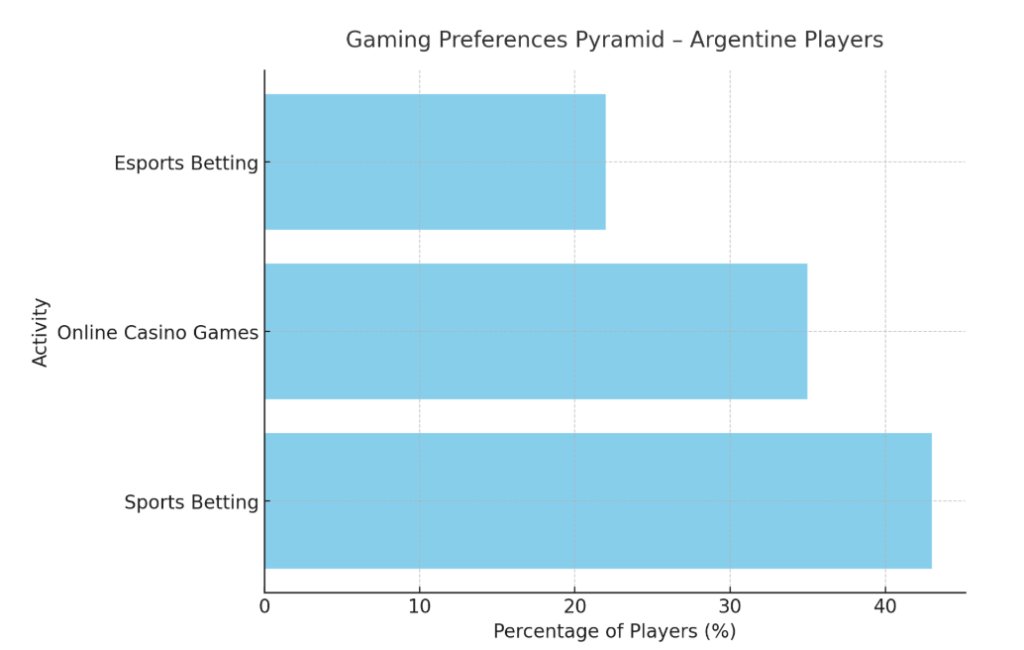

The most preferred activities include:

These behaviors align with a generational shift: players aged 18–35 now dominate digital gaming activity. They value speed, interactivity, and seamless integration with mobile apps. Features like live dealer games, VR casinos, and instant crypto withdrawals particularly appeal to this cohort.

Weekly expenditure remains moderate but consistent. Around 36% of players spend between ARS 1,000 and 5,000 (USD 1–5) on gaming activities, showing broad affordability that sustains mass participation.

Argentina’s esports betting market has become one of the fastest-growing verticals. Valued at US$22.7 million in 2025, the segment is expected to expand annually as global tournaments, local leagues, and influencers shape gaming culture.

Titles such as Counter-Strike 2, League of Legends, and Valorant now dominate both viewership and betting landscapes. Local tournaments like FiRe League and Gamergy Argentina attract large online audiences and drive live betting activity.

Operators that integrate esports markets into mobile platforms are gaining significant traction. For example, Betsson’s mobile app has built a strong reputation for offering esports odds with intuitive interfaces and fast payouts, showcasing how international operators localize their presence in Argentina (learn about the Betsson app here).

Moreover, esports betting is reshaping the perception of gambling among younger demographics. For many, it represents entertainment intertwined with skill and community rather than chance alone.

No conversation about gaming in Argentina is complete without soccer. The sport remains the backbone of the country’s betting behavior, accounting for more than half of total wagers.

From local tournaments like the Primera División to European leagues featuring Argentine stars, football dominates real-time betting markets. Operators have adapted by integrating live betting and cash-out features through intuitive apps such as Codere’s mobile platform, one of the most widely used betting tools in the country.

During major events like the World Cup or Copa América, betting volumes spike by as much as 300%. The influence of social media, sports journalism, and fan-driven discussion amplifies these surges, transforming matches into nationwide betting events that unify technology and national pride.

Payment methods in Argentina’s online gaming environment have evolved substantially. Digital wallets now account for nearly half (49%) of all gaming transactions, while traditional credit and debit cards trail behind.

Players appreciate instant withdrawals, low commissions, and the ability to transact without banks. Cryptocurrency payments—mostly in Bitcoin, USDT, and Ethereum—are also on the rise among high-frequency gamers due to privacy and transaction efficiency.i

In this context, operators that combine APMs (Alternative Payment Methods) with AI-driven fraud prevention gain stronger user confidence. Blockchain is increasingly used for transaction transparency and random number generation in casino games, ensuring fair play.

Argentina’s gaming regulation model is distinctive. Unlike neighboring countries such as Chile or Brazil, the regulation process occurs at the provincial level.

Buenos Aires Province and City have been pioneers, introducing clear licensing frameworks, taxation systems, and mandatory responsible gaming requirements. Córdoba followed suit, enabling dozens of new iGaming operators to obtain legal status.

However, smaller provinces like Chaco, Mendoza, and Neuquén are still navigating legal uncertainty. The result is a patchwork of local rules, pushing operators to design flexible compliance models.

Nonetheless, this system offers opportunities. Brands entering early in regulated provinces capture market share quickly while compliance barriers deter global giants from monopolizing the field.

Argentine gaming culture is not just about leisure—it’s about belonging. Online gaming brings together societal elements that mirror national identity: soccer loyalty, collective excitement, and an entrepreneurial digital spirit.

In many ways, betting has become part of everyday conversation, from family WhatsApp groups discussing match odds to TikTok influencers showcasing gaming strategies. The integration of social sharing within betting platforms turns gambling into a communal experience rather than a solitary one.

At the same time, this social acceptance has raised concerns about underage exposure. Responsible gaming initiatives—such as verification processes, educational campaigns, and spending limits—have become central to maintaining sustainable growth.

The 2025 Argentine iGaming landscape is also defined by innovation. Emerging technologies are not limited to payment solutions—they shape the very structure of gameplay and interaction.

These tools not only improve user experience but also attract international investors who view Argentina as Latin America’s testbed for emerging iGaming technologies.

While growth metrics remain impressive, the industry faces notable hurdles.

The gray market—comprising unregulated operators serving Argentine players without provincial approval—remains massive. Estimates suggest 80% of total bets take place on these unlicensed platforms. This proliferation undermines tax collection and exposes players to potential fraud or unfair practices.

Moreover, many users cannot clearly differentiate between legal and illegal betting sites. Strengthening public awareness, expanding provincial cooperation, and simplifying licensing systems are key priorities for future regulation.

Another enduring challenge involves responsible gambling. With accessibility at an all-time high, the importance of robust self-exclusion features, spending trackers, and educational campaigns continues to grow.

Once dominated by men aged 18–40, the Argentine online gaming demographic now includes a growing female player base, particularly in casual games, slots, and mobile app trivia contests.

Women account for roughly 30–35% of total online gamblers, and their participation is climbing, influenced by mobile accessibility and the social aspects of online play.

Casual gamers—those who bet lower amounts more frequently—also represent a meaningful segment. For this group, microtransactions, “freemium” models, and entertainment value outweigh monetary gains.

Advertising spending in the online betting industry has soared, with Google Ads campaigns surpassing US$4.2 million for sports betting and US$1.4 million for casino-related ads between 2024 and 2025.

Media personalities and social networks play significant roles in promoting responsible, localized gaming narratives. Brands now leverage influencers, podcasts, and sports shows to target hyper-specific demographics who associate betting with national sports enthusiasm and smart entertainment rather than risk.

Looking forward, Argentina’s iGaming ecosystem is likely to evolve around three major pillars:

For operators, Argentina remains one of Latin America’s most promising yet demanding arenas. Success depends on combining cultural insight with compliance innovation—building platforms that feel local while operating with global standards.

Argentina’s online gaming boom in 2025 exemplifies a transformative convergence between technology, culture, and regulation. It is a story of local passion meeting digital modernity. From bustling esports tournaments to everyday mobile wagers on Sunday soccer, gaming has become an expression of national identity.

With the expansion of secure apps, transparent laws, and real-time engagement tools, Argentina’s iGaming market is poised not only for growth but for leadership in Latin America’s digital entertainment economy.

In summary, Argentina’s online gaming scene in 2025 is characterized by strong growth in users and revenues, a dominant mobile-first gaming approach, and burgeoning interest in esports betting. The decentralized regulation model shapes this dynamic landscape, requiring operators to be agile and compliant. The combination of economic challenges and digital advancement makes this a compelling market to watch within Latin America’s gaming ecosystem.

Related

Betting in the UK: From Early Gambling Laws to Today’s Online Bookmakers

The Future of Online Betting: How Technology Is Redefining the Game